Update about newest rate cut from SBV:

WHAT? – Vietnam’s central bank, SBV, has taken further measures to ease monetary policies by cutting rates. In its latest move, the refinancing rate and 6-month deposit rate cap were both lowered by 50bps from 6.0% to 5.5% p.a. After two rounds of cutting different kinds of rates, all policy rates were reduced by 50bps ytd.

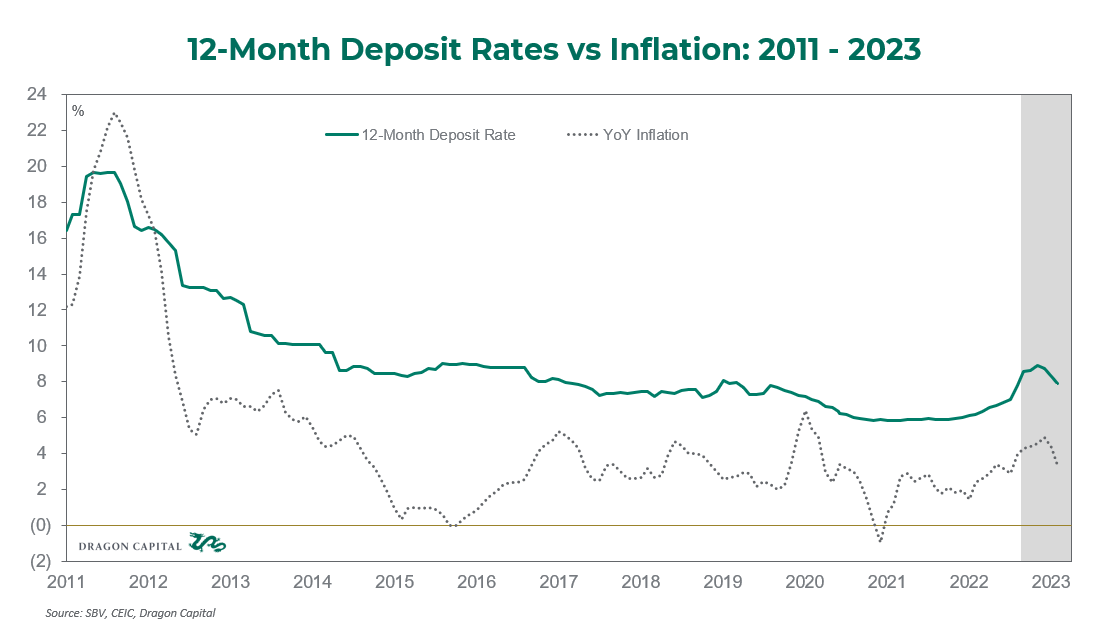

HOW CAN? – Vietnam’s favorable conditions and manageable inflation make it possible for the country to reduce rates. The pressures from currencies, which led to a 200bps rate hike last year, have significantly reduced following recent events in the US market. There is now an expectation that the FED may end its tightening cycle earlier than anticipated, making a less speculative and hoarding USD pressures. Additionally, Inflation seems to be manageable, declining by 0.23% mom and only increasing by 3.4% yoy in Mar. Vietnam also boasts some of the highest real interest rates of 4.0%-5.0% in the world.

WHY? – Reducing local funding costs is a necessary measure to stimulate the economy. The 1Q23 GDP growth rate of 3.3% yoy was only slightly higher than the 3.2% yoy in 1Q20, the Covid year. To achieve the growth target of 6.5% for 2023, the economy needs to grow by 7.5% over the next nine months, requiring supportive measures. A lower interest rate environment can support the real estate and corporate bond market, reducing borrowing costs for enterprises and incentivizing people to return to these markets.

CONCLUSION – We believe that the SBV’s actions regarding policies and regulations are quite timely and flexible and Vietnamese Government will implement more accommodative policies in the near future to promote growth for the remaining year.