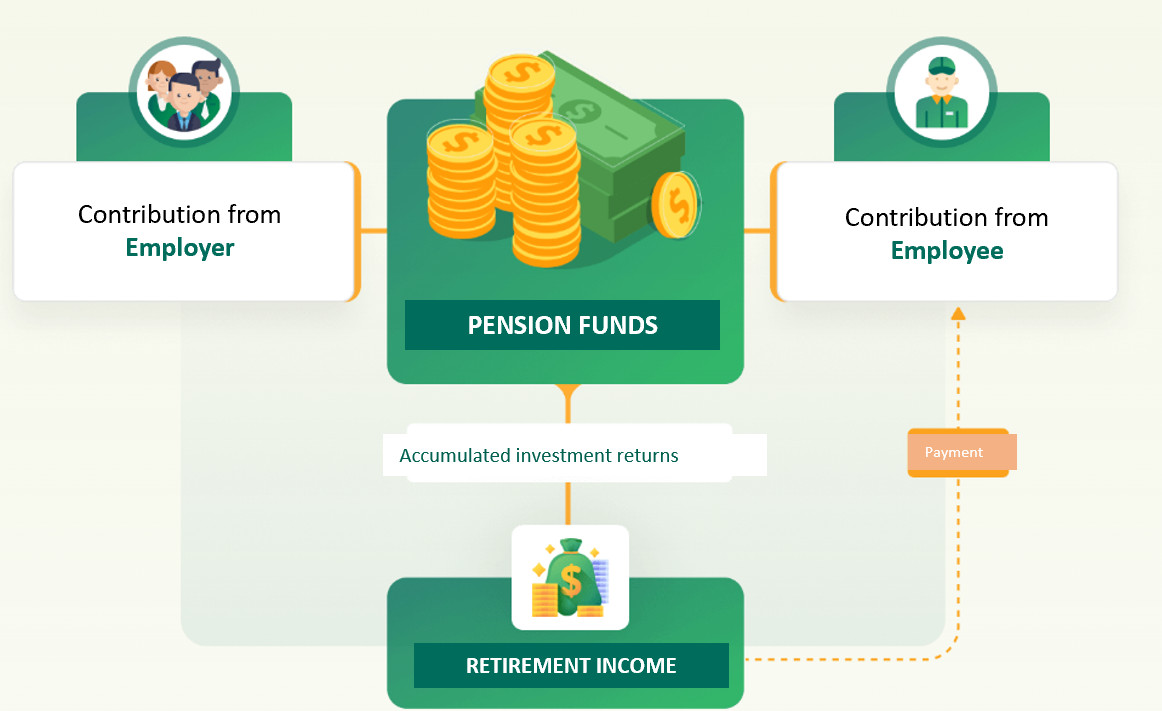

PENSION FUND CONCEPT

PENSION FUND CONCEPT

-

New financial instrumentA new type of benefit that allows Enterprise and Employees to jointly contribute to increase the Employee’s retirement income

-

Managed by investment expertsThe pension account will be managed by a team of experienced investment experts of DCVFM

-

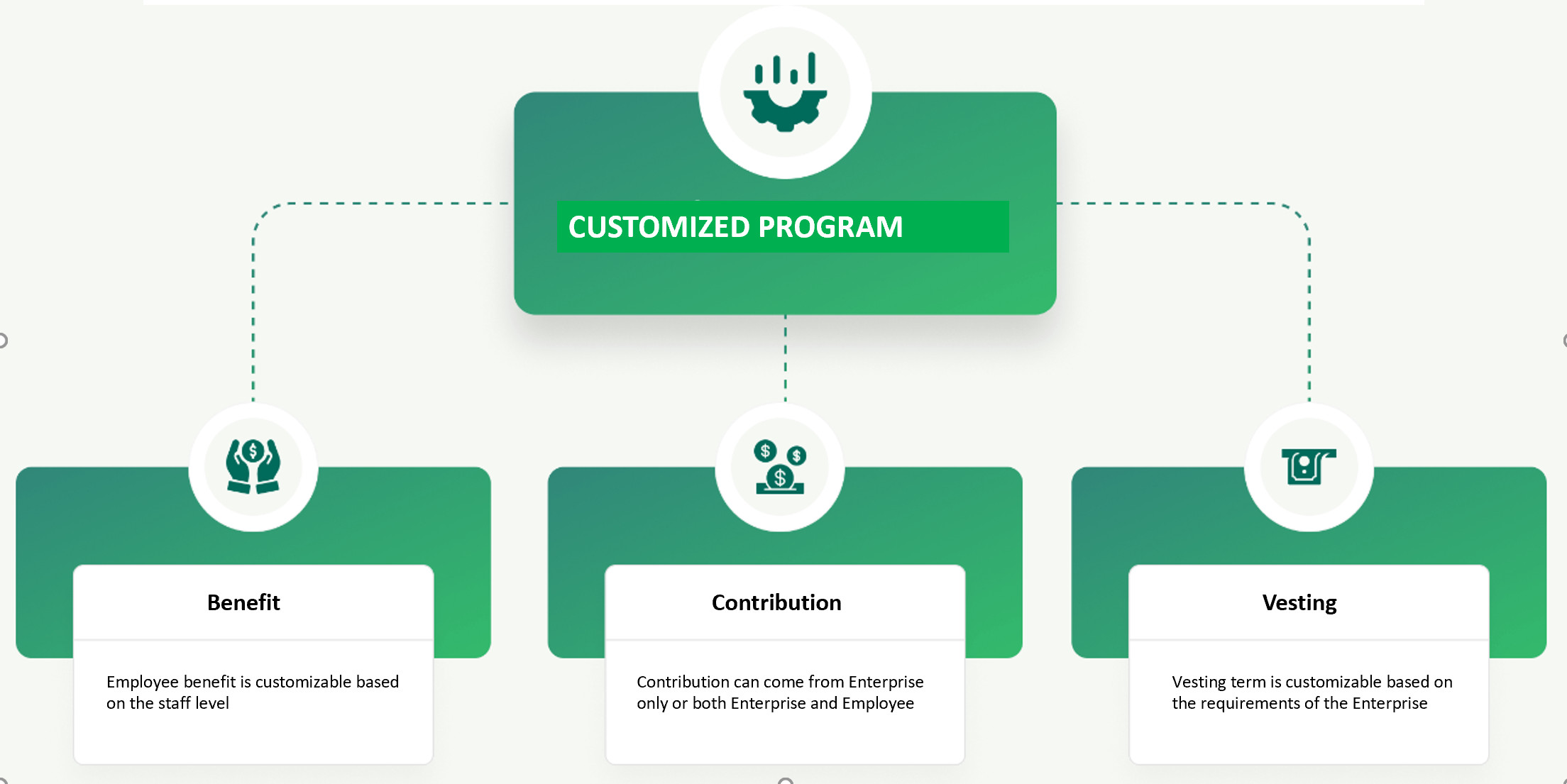

Flexible designPension program can be designed and customized to meet requirements of the enterprise

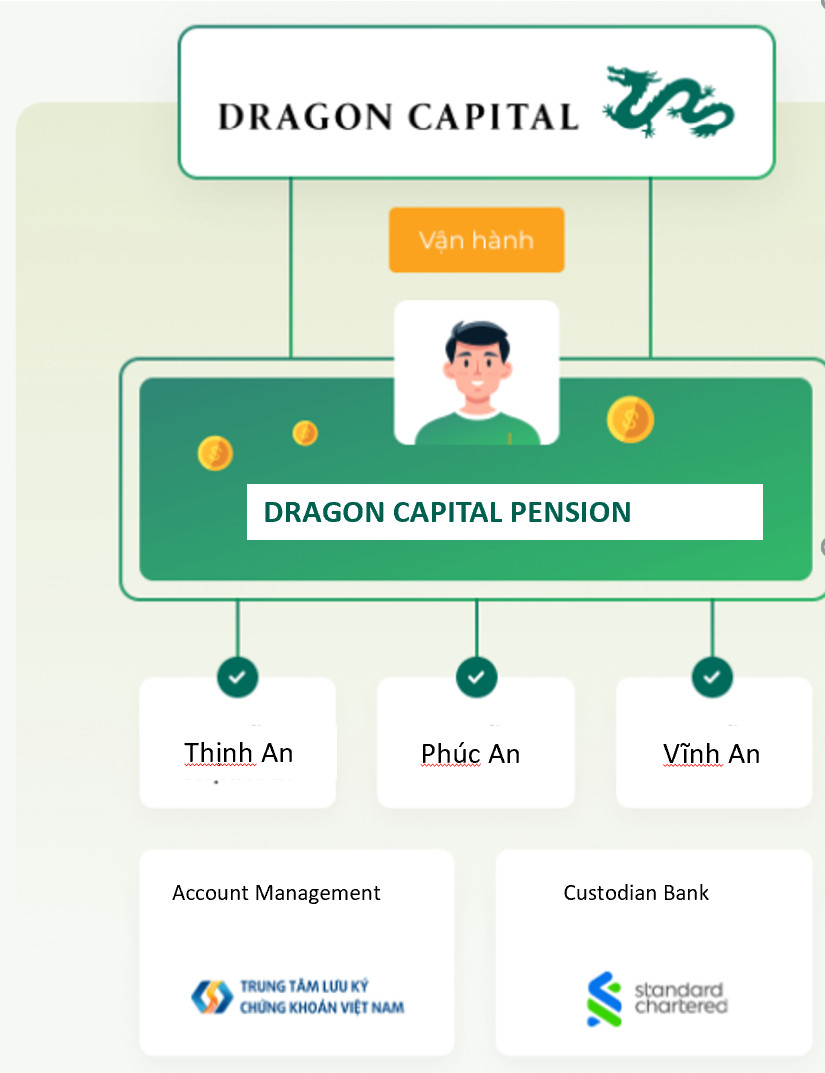

DRAGON CAPITAL PENSION

As the first Supplemental Pension Program in Vietnam, Dragon Capital Pension is operated by Dragon Capital and has been assessed and licensed by the Ministry of Finance

DCVFM has been granted with the voluntary supplemental pension fund management services license No. 01/GCN-QLQHTBSTN on May 15. 2019 by the Ministry of Finance

BENEFITS FOR EMPLOYER

BENEFITS FOR EMPLOYER

Enhance Employee Benefits

An opportunity to improve employee benefits package of the company

Maximize the Efficiency of HR Expenses

Fund certificates are refunded if the vesting conditions are not fulfilled

Corporate Income Tax Benefit

VND 3 Million/ employee/ month

A Comprehensive Management Solution

Online DC Pension Portal

FULLY CUSTOMIZABLE

AVAILABLE PENSION FUNDS

3 pension funds are designed to suit different the risk appetite and investment needs.

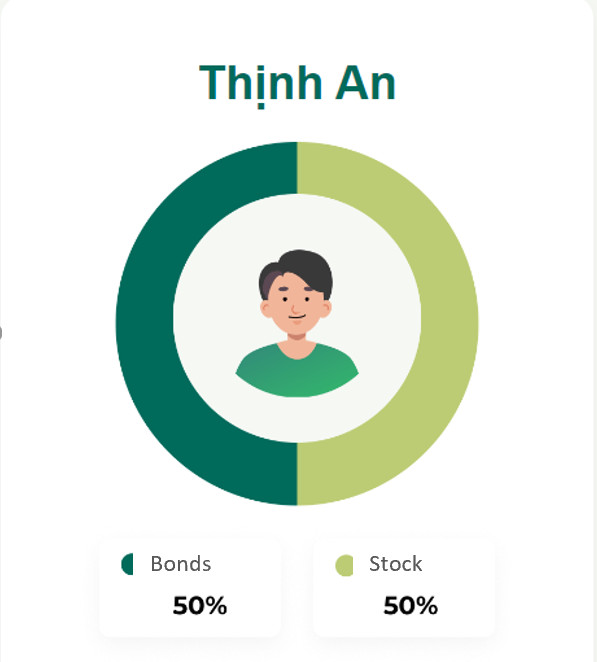

Thịnh An

Higher risks for higher returns

- Age < 36

- Participation ≥ 25 years

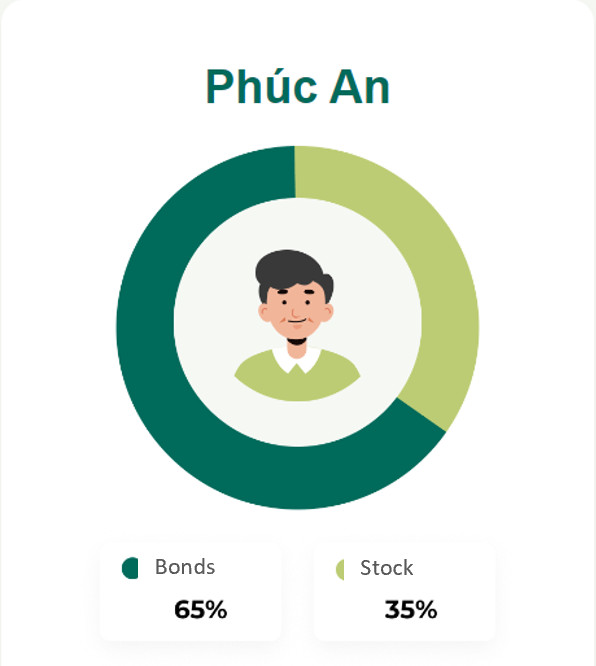

Phúc An

Balanced between risks and returns

- 36 < Age ≤ 50

- Participation < 25 years

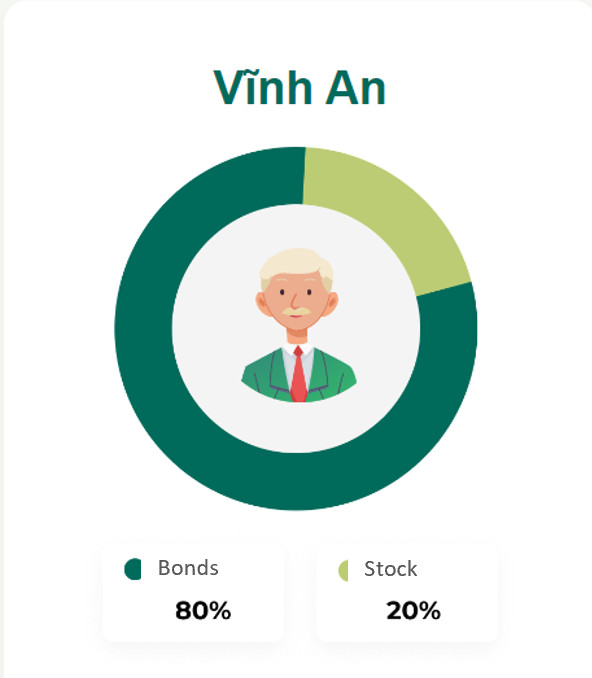

Vĩnh An

Conservative and low-risk investment

- Age ≥ 51

- Participation ≤ 10 years

HOW TO PARTICIPATE

Contact the consultation team

Develop the pension program based on Enterprise’s requirements

Enterprise signs the Framework contract with Dragon Capital

Employee registration and contribution

FREQUENTLY ASKED QUESTIONS

FREQUENTLY ASKED QUESTIONS

Can not find a question you are interested in? Contact now

Request form for more information